type below and hit enter

Search the blog

SCHOOL SALES

SCHOol Support

START A SCHOOL

Browse by topic

I'm Dr. Jeannie Gudith, Founder and CEO of JAG Consulting. We help you develop, improve, buy or sell your private school.

I'm so glad you're here

Accounting for Deferred Revenue in Private Schools

Uncategorized

Accounting for deferred revenue is the practice of recording payments you've received for educational services before you've actually delivered them. For private schools, this is a daily reality. It means treating prepaid tuition or camp fees as a liability on your balance sheet—not as immediate income—until you provide the service over the academic term. According to a survey by the National Business Officers Association (NBOA), over 90% of independent schools collect at least a portion of tuition in advance, making deferred revenue a critical component of their financial management.

What is Deferred Revenue in a School Setting?

Let's move beyond the textbook definitions. Deferred revenue isn't just an accounting entry; it's a critical indicator of your school's financial health and future obligations. It represents a promise you've made to your families to deliver educational value down the road.

You run into deferred revenue scenarios constantly. Think about the annual tuition payments that start arriving in July, the fees you collected back in the spring for a summer camp, or the enrollment deposits you secured for the next school year. The cash is in your bank account, sure, but you haven't truly "earned" it yet.

Think of it this way: When a parent pays the full year's tuition over the summer, your school has received the cash but now holds an obligation. That payment only becomes earned income month by month as students attend classes and you fulfill your educational promise.

Why This Distinction Matters

Properly tracking this liability is absolutely vital for accurate financial management. It gives you a crystal-clear view of your actual earned income versus the cash you have on hand. This separation is fundamental for several key operational areas:

- Accurate Budgeting: It prevents you from overstating your monthly income and making spending decisions based on cash that is already tied to future services.

- Strategic Planning: Understanding your deferred revenue balance gives you a reliable forecast of future earned income, which is essential for planning new programs or capital improvements.

- Building Trust: It demonstrates sound financial stewardship to your board, lenders, and accrediting bodies, showing that you have a precise handle on your school's financial position.

To really get a handle on deferred revenue, which is an accrual concept, it's worth understanding the crucial difference between cash basis and accrual basis accounting.

What Does This Look Like in Practice?

Almost every private school has multiple streams of income that should be deferred. Here’s a quick breakdown of the most common ones.

Common Deferred Revenue Sources in Private Schools

| Revenue Source | When It Becomes Deferred Revenue | When It Becomes Earned Revenue |

|---|---|---|

| Annual/Semester Tuition | The moment payment is received before the first day of the academic period it covers. | Monthly, as each month of instruction is completed. |

| Enrollment Deposits | When the non-refundable deposit is paid to secure a spot for the next school year. | On the first day of school, when the student enrolls and the service period begins. |

| Summer Camp Fees | When a family pays in the spring to register their child for a July camp session. | On a pro-rata basis as the camp session progresses (e.g., daily or weekly). |

| Extended Care/After-School Programs | When payment is received for a full semester or year of after-care services. | Monthly or weekly, depending on the service period covered by the payment. |

| Technology or Activity Fees | When collected at the start of the year to cover costs for the entire academic year. | Systematically over the 10-month school year. |

This table shows just how many of a school's typical revenue streams are, by definition, liabilities when first received.

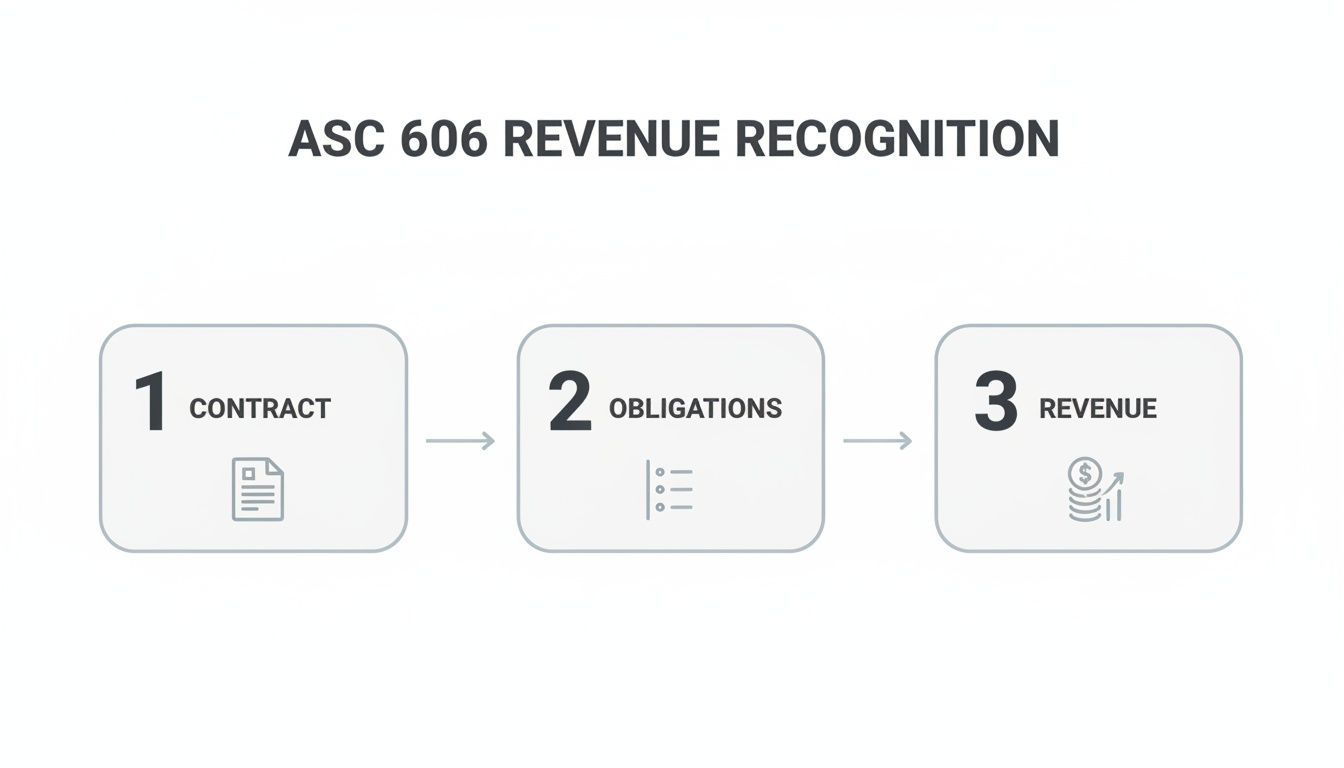

The Impact of Modern Accounting Standards

The introduction of ASC 606 formalized this process, requiring organizations to defer revenue until performance obligations—like delivering a full school year of instruction—are met. This isn't just a minor bookkeeping rule. A PwC study noted a 15-20% average increase in deferred revenue balances after its implementation, showcasing just how significant these funds are.

Even more telling, a 2023 KPMG analysis found that in acquisitions, deferred revenue is often valued at 85-95% of its book value, directly influencing a school's sale price. Proper accounting here has a real, tangible impact on your school's valuation.

Navigating these financial principles is key to your private school's long-term stability and growth. If you need expert guidance to align your accounting practices, our team at JAG Consulting can help. Book a complimentary consultation call with us today or visit our website to learn more.

Applying ASC 606 Rules to Your School's Books

Diving into accounting standards like ASC 606 can feel like trying to read a foreign language. But once you translate it into the day-to-day reality of running a private school, the core ideas are surprisingly practical. At its heart, the standard is designed to answer one simple question: "When did we actually earn this money?"

For private schools, this question is critical. You collect huge amounts of cash upfront for tuition, camps, and fees, but you haven't delivered the service yet. ASC 606 forces a discipline that gives a much truer picture of your school's financial health.

In fact, since ASC 606 was rolled out, companies have seen a 15-20% average jump in their reported deferred revenue. That tells you just how much income was being booked way too early.

The Five-Step Model in Plain English

Instead of thinking of ASC 606 as a set of rigid rules, think of it as a logical path to follow for every dollar that comes in the door. It ensures you only recognize revenue when you've held up your end of the bargain with a family.

Step 1: Identify the Contract. For a school, this is almost always the signed enrollment agreement. It’s the official handshake that outlines the services you promise to provide and what the family agrees to pay. Simple enough.

Step 2: Identify the Performance Obligations. This is where you get specific. A "performance obligation" is just a fancy term for a distinct promise you've made. The 10-month academic year is one big performance obligation. But what about that optional spring break trip? That’s another one. After-school care billed by the semester? That’s a third. You have to break down the contract into each separate service you've agreed to deliver.

Putting a Price Tag on Your Promises

Once you know what you’ve promised, the next steps are all about assigning a value to each of those promises so you can recognize the revenue on the right timeline.

Step 3: Determine the Transaction Price. This is the total amount you expect to collect from the family for everything in the agreement. Let's say a family pays $20,000 for annual tuition plus a $2,000 technology fee. The total transaction price is $22,000.

Step 4: Allocate the Transaction Price. Now you connect the money to the promises. You take that total price and spread it across the performance obligations you identified. If the academic year and the tech support are bundled into a single service, the whole $22,000 gets allocated there. But if you also sold them a separate, optional tutoring package for $1,500, that amount gets allocated specifically to that tutoring service. This is what keeps you from recognizing revenue for an April field trip back in September.

Properly separating your performance obligations isn't just about compliance. It’s a powerful tool that gives you incredible insight into the real profitability of your auxiliary programs. You can finally see which services are truly driving your school's financial success.

Recognizing Revenue as You Earn It

The final step is where it all comes together. This is the moment you can finally move money from the liability side of your balance sheet to the income side of your P&L.

- Step 5: Recognize Revenue When (or as) Obligations are Satisfied. For the core $22,000 academic program, you satisfy that obligation over time. You’d recognize that revenue on a straight-line basis over the 10-month school year—or $2,200 per month. For a one-week summer camp, you’d recognize all the revenue for that camp during that specific week.

Following this model stops the all-too-common mistake of booking a family's full tuition payment as income the day the check clears. This disciplined approach means your financial statements are accurate, your audits go smoother, and your board gets a reliable, real-time view of the school’s performance.

If getting these standards implemented feels overwhelming, we can help. The team at JAG Consulting lives and breathes this stuff, and we specialize in building financial frameworks that make sense for private schools. Book a call with us to see how we can bring this clarity to your accounting, or visit our website.

Practical Journal Entries and Amortization Schedules

Theory is great, but let's get into the mechanics of how deferred revenue actually works in your school's books. This is where the abstract accounting rules become a clear, predictable workflow for handling the most common transaction you see: a family prepaying annual tuition.

When that check arrives, you haven't actually earned the money yet. Your school has received cash, but in exchange, you've created a liability—a promise to deliver a full year of education.

The Initial Journal Entry for Prepaid Tuition

Let's use a real-world scenario. A family pays the full $20,000 annual tuition on July 15th for the upcoming school year, which runs from September to June. The cash is in the bank, but you haven't held a single class.

Your bookkeeper's first job is to record the cash and create the corresponding liability. The journal entry is straightforward:

| Account | Debit | Credit |

|---|---|---|

| Cash | $20,000 | |

| Deferred Revenue | $20,000 | |

| To record receipt of prepaid annual tuition |

This entry gives an honest picture of your financial position. Your cash is up, but so is your obligation to that family. That $20,000 now sits on your balance sheet as Deferred Revenue, a current liability.

Creating a Monthly Tuition Amortization Schedule

Now comes the crucial part: systematically recognizing that revenue as you earn it. Since the school year is 10 months long, you will earn 1/10th of the total tuition each month. This process of moving funds from the liability account to the income account is called amortization.

An amortization schedule is your roadmap. For the $20,000 tuition, the monthly amount you recognize is $2,000 ($20,000 / 10 months).

At the end of September, after you've delivered the first month of school, you'll make an adjusting journal entry. This entry does two things: it reduces your liability and recognizes the income you’ve officially earned.

| Account | Debit | Credit |

|---|---|---|

| Deferred Revenue | $2,000 | |

| Tuition Income | $2,000 | |

| To recognize one month of earned tuition revenue |

You will repeat this exact entry at the end of every single month from September through June. This disciplined, monthly process is what ensures your income statement accurately reflects your school's performance in the period it actually occurred.

Here's how that $20,000 moves from a liability to earned revenue over the academic year:

Sample Monthly Tuition Amortization Schedule

| Month | Beginning Deferred Revenue | Revenue Recognized This Month | Ending Deferred Revenue |

|---|---|---|---|

| September | $20,000 | $2,000 | $18,000 |

| October | $18,000 | $2,000 | $16,000 |

| November | $16,000 | $2,000 | $14,000 |

| December | $14,000 | $2,000 | $12,000 |

| January | $12,000 | $2,000 | $10,000 |

| February | $10,000 | $2,000 | $8,000 |

| March | $8,000 | $2,000 | $6,000 |

| April | $6,000 | $2,000 | $4,000 |

| May | $4,000 | $2,000 | $2,000 |

| June | $2,000 | $2,000 | $0 |

By the end of June, the Deferred Revenue liability for this family is $0, and you've recognized the full $20,000 as Tuition Income. Your books are clean, accurate, and audit-ready.

Tracking deferred revenue isn't just a best practice for private schools; it's a key indicator of financial health and future performance in many industries. High deferred revenue balances signal strong forward-looking demand and predictable cash flow.

This simple flow—identifying the contract, defining the obligations, and recognizing revenue as they are met—is the foundation of proper accounting under ASC 606.

Handling Other Common School Fees

The same logic applies to other advance payments you collect. The golden rule is to match the revenue recognition to the period when the service is delivered.

- Summer Camps: A family pays $1,200 in April for a three-week camp in July. You don't recognize any of it in April. Instead, you'd recognize $400 in revenue at the end of each week of the camp in July.

- Non-Refundable Deposits: That enrollment deposit a family pays in March to secure a spot for the fall? It’s pure deferred revenue until the first day of school. The moment classes start, your obligation to hold that spot has been fulfilled, and the entire deposit is recognized as earned.

For example, a $1,000 deposit would be moved from the Deferred Revenue liability account to an Earned Revenue income account on the first day of classes.

The predictive power of these balances is significant. In a recent quarter, Salesforce reported deferred revenue of $12.5 billion, a 12% year-over-year increase, signaling strong future performance to investors. Similarly, M&A data shows that companies with a high percentage of deferred revenue often command valuation multiples that are 20-30% higher in a sale. For a private school owner, this proves that properly deferring tuition not only cleans up your financial reporting but can also substantially increase your school’s valuation.

Getting these journal entries and schedules set up correctly is foundational to your private school's financial integrity. If you need help building these systems or want to ensure your books are ready for an audit or potential sale, the experts at JAG Consulting are here to help. Schedule a complimentary call with us today to get started, or visit our website for more information.

Using Deferred Revenue for Strategic Growth

Once you get the mechanics of deferred revenue down, it’s easy to file it away as a compliance task—just another liability to manage. But that’s where most private schools miss the real opportunity. Let's move beyond the journal entries and start thinking like a CFO.

A healthy, growing deferred revenue balance is one of the most powerful leading indicators of your school's financial future. It’s a direct reflection of market demand, parent commitment, and the predictability of your income. When that number climbs year after year, it’s not just an accounting entry; it's hard proof that families are voting with their wallets, paying months in advance to secure their child’s spot.

Presenting Deferred Revenue to Your Board

When you're asking your board to approve a major investment—like a campus expansion or a new technology initiative—data is your best friend. Deferred revenue trends provide the kind of compelling, forward-looking evidence that inspires confidence.

Instead of just showing historical performance, you can build a much stronger case by presenting a multi-year analysis of your deferred revenue growth.

- Show the Growth: A simple chart illustrating a consistent rise in prepaid tuition is powerful. It demonstrates strong, reliable demand that can easily support the debt service for a new building.

- Highlight Predictability: Your deferred revenue balance isn't hypothetical; it's contracted, predictable income you will earn over the next 10 months. This dramatically reduces the perceived risk of any new investment.

- Connect to Enrollment: A high deferred revenue figure in March for the next school year is concrete proof of your admissions and retention success. It reinforces the case for funding new programs to meet that proven demand.

Using this approach transforms a liability account into a strategic forecasting tool. It reframes the conversation from "Can we afford this?" to "How can we best invest to support this incredible demand?"

Increasing Your School’s Valuation

For private school owners thinking about a future sale or bringing on a partner, a well-documented deferred revenue balance is one of your most valuable assets. It’s technically a liability, but any sophisticated buyer will see it as a massive strength, not a risk.

Why? Because a large deferred revenue balance is proof of a stable, locked-in customer base. It tells a potential buyer that the school has a guaranteed stream of income for the entire upcoming academic year, which significantly de-risks their investment.

A potential buyer sees a healthy deferred revenue balance and doesn't see a debt. They see a full roster of committed families, predictable cash flow for the next 10 months, and a strong market reputation. It’s a powerful de-risking factor that directly commands a higher purchase price.

This isn't just a theory. Research from firms like SaaS Capital and KeyBanc Capital Markets has shown that companies with deferred revenue representing over 25% of their annual recurring revenue often secure 25-35% higher valuation multiples. For a private school, this means valuing your enrollment contracts at their fair value during a sale—often 90% of face value—can add a substantial amount to the final deal. You can discover more about how deferred revenue impacts valuation in this detailed analysis.

By weaving this data into your financial models and strategic narrative, you can prove the underlying strength and predictability of your school’s business model. It gives you a huge advantage, whether you're negotiating with a lender for an expansion or with a buyer for a successful exit.

If you're ready to harness the strategic power of your school's finances for growth or a potential sale, our team at JAG Consulting has the expertise to guide you. Book a complimentary consultation call today or visit our website to learn how we help private school owners achieve their goals.

Strengthening Internal Controls for Audit Readiness

Properly accounting for deferred revenue is one thing; proving it's accurate to an auditor is a whole different ballgame. This is where strong internal controls become your private school's best defense against errors, misstatements, and the inevitable headaches that come with an audit.

Think of these controls not as bureaucratic red tape, but as the operational backbone that guarantees financial integrity. Get them right, and you'll build unshakable confidence with your board, lenders, and accrediting bodies.

The primary goal here is simple: minimize risk. A study by the Association of Certified Fraud Examiners found that organizations with weak internal controls suffer significantly larger financial losses. For a private school where every dollar is mission-critical, that's a risk you just can't afford to take.

Core Controls for Deferred Revenue Management

Implementing a few fundamental controls can drastically improve the accuracy and defensibility of your deferred revenue accounting. I’ve seen these work time and time again in private school settings.

First up is the segregation of duties. This principle is simple but incredibly effective. The person responsible for collecting tuition payments should not be the same person recording those transactions in the general ledger or authorizing revenue recognition entries. This separation creates a natural check and balance, making it far more difficult for errors—or worse, intentional misstatements—to go unnoticed.

Another critical control is maintaining detailed subsidiary schedules for deferred revenue. Your general ledger will just show a single, large number for your deferred revenue liability. This control means you keep a separate, detailed schedule that lists every single source of that balance—every student, every prepaid program—that ties out perfectly to the general ledger total. Trust me, this schedule is often the first thing an auditor will ask to see.

Regular reconciliation is the heartbeat of strong internal controls. At the end of each month, your business office must formally reconcile the detailed deferred revenue schedule to the general ledger account balance. Any discrepancy, no matter how small, must be investigated and resolved immediately. This monthly discipline prevents small issues from snowballing into major audit findings.

To really strengthen your processes, it's crucial to have a clear understanding of the definition of an audit trail and its role. This system-level tracking provides auditors with the verifiable evidence they need to see how a number got from Point A to Point B.

Your Practical Audit Readiness Checklist

When auditors arrive, being prepared can turn a stressful, months-long process into a smooth and efficient one. It demonstrates professionalism and a high level of financial stewardship. Here’s a practical checklist to get your team ready.

- Gather All Enrollment Contracts: Have organized digital or physical copies of every signed enrollment agreement for the audit period. These are the primary evidence of your performance obligations.

- Compile Payment Records: Prepare detailed reports showing the date and amount of every tuition and fee payment received. This documentation supports the initial cash receipt and the creation of the deferred revenue liability.

- Present Amortization Schedules: Have your detailed amortization schedules ready, showing the month-by-month recognition of revenue for each student or program.

- Document Your Policies: Provide a written document outlining your school's revenue recognition policies, including how you handle withdrawals, refunds, and non-refundable deposits.

Taking these proactive steps will not only simplify your annual audit but also fortify the financial integrity of your school for years to come.

It’s Time to Master Your School's Finances

Getting a handle on deferred revenue is so much more than a box-ticking compliance exercise. It's one of the cornerstones of a truly sustainable financial strategy for your private school. When you get this right, you unlock critical insights into future performance, sharpen your financial forecasting, and can even dramatically increase your school's valuation.

When you implement these practices, you're building a resilient financial foundation that inspires genuine confidence from your board, your parents, and your entire community. It’s no secret that organizations with strong financial controls and transparent reporting are simply better positioned for long-term stability and growth. For a private school, that translates directly into greater trust and a much stronger enrollment pipeline.

A well-managed deferred revenue balance sends a powerful signal about your school’s health. It’s hard proof of robust demand and predictable income—a key factor that can boost a private school's valuation by 20-30% in a potential sale or merger.

By mastering this one area, you shift from reactive bookkeeping to proactive, strategic financial leadership.

Take Control of Your School’s Future

If you could use an expert guide to put these strategies into action, refine your financial modeling, or get your school ready for its next chapter, we're here to help. The specialists at JAG Consulting have decades of hands-on experience navigating the unique financial landscape of private schools.

Let's take the next step toward financial clarity and strategic advantage together.

Book a complimentary consultation call with JAG Consulting today or visit our website to talk about your school's unique goals.

Common Questions We Hear in the Business Office

Even when you've got a handle on the basics of deferred revenue, real-world situations pop up that can make things tricky. Here are some of the most common questions we get from private school leaders trying to nail down their accounting practices.

What Happens When a Student Withdraws?

This is a big one. When a student leaves mid-year, what you do next is dictated entirely by your signed enrollment agreement and your school's refund policy. That remaining balance in their deferred revenue account needs to be dealt with right away.

First, you’ll immediately recognize any tuition that you've already earned up to the withdrawal date. It's the unearned portion that requires a decision.

- If you issue a partial refund: You'll clear the rest of the student’s balance from your Deferred Revenue liability account. Part of that amount will be a credit to Cash (for the refund you paid out), and the other part—the non-refundable portion you keep—gets credited to an income account like Forfeited Deposits/Fees.

- If no refund is due: The entire remaining balance of unearned revenue is recognized as income immediately. We typically see this recorded in an account like "Forfeited Tuition Income" because, according to your contract, you've fulfilled your obligation.

How Should We Handle Multi-Year Contracts?

For those multi-year enrollment contracts or even capital campaign pledges that get paid upfront, the principle is the same: you can only recognize revenue as you deliver the service. It's a major red flag to recognize a multi-year payment entirely in the first year.

The right way to do this is to set up a long-term liability account on your balance sheet, usually called something like "Deferred Revenue – Long Term."

The portion of the contract you’ll earn in the next 12 months stays right where it is, in your current Deferred Revenue account. Everything beyond that 12-month window goes into the long-term account. Then, once a year, you’ll make a journal entry to reclassify the next 12 months' worth of revenue from the long-term bucket back into the current liability account.

Can Our Current Accounting Software Manage This?

Most modern accounting software like QuickBooks or Xero can absolutely handle deferred revenue, but it almost always requires a bit of manual setup and ongoing attention. The key is to look for features that let you create recurring journal entries—that can automate the monthly amortization and save you a ton of time.

But let's be realistic. As private schools grow, trying to manage hundreds of individual student schedules in a generic accounting system gets incredibly clunky. This is where specialized school management systems with built-in accounting modules really shine. They're designed from the ground up to automate these specific workflows, which dramatically cuts down on the risk of manual errors—the kind of errors that research shows can distort financial statements by up to 15%.

Mastering the nuances of deferred revenue isn't just an accounting exercise; it’s a critical step toward ensuring your private school's long-term financial stability and strategic growth. If you need expert guidance to implement these practices or prepare for your next chapter, our team at JAG Consulting is here to help.

Book a complimentary consultation call to discuss your school's unique financial goals, or visit our website for more details.

I'm Dr. Jeannie Gudith, Founder and CEO of JAG Consulting. We help you develop, improve, buy or sell your private school.

I'm so glad you're here

Hello!

© 2025 JAG CONSULTING.

all rights reserved. privacy policy + REFUND POLICY. TEMPLATE by sugar studios + Showit